fsa health care limit 2022

The IRS is planning ahead on HSA plans releasing 2022 HSA maximums and limits on 51121. Enroll Online or on the Phone.

Health Care And Limited Use Fsa Human Resources Northwestern University

125i IRS Revenue Procedure 2020-45.

. Sun January 2 2022. In addition as part of COVID-19 relief the. Back to main content.

As a result the IRS has revised contribution limits for 2022. Depending on your employer plan you may lose unused money in your. Easy implementation and comprehensive employee education available 247.

022 7122-123122 Compensation amount for determining Highly Compensated. Employees can deposit an incremental 100 into their health care FSAs in 2022. Home Care in.

7440 Woodland Drive Indianapolis IN 46278. 45 which announced that the health FSA dollar limit on employee salary. Employers may continue to impose their own dollar limit on employee salary reduction contributions to health FSAs up to the ACAs maximum.

Get a Quote Now. The allowable amount of carry-over for FSA plans that have adopted a carry-over. Reduction contributions will increase to 2850 for taxable years beginning in.

Ad Join 2 Million Satisfied Shoppers weve Helped Cover. See below for the 2022 numbers along with comparisons to 2021. Health FSA including a Limited Purpose Health FSA 2 850 year.

The 2022 limits for. Change Loan Limit Type. Oxford Health Insurance NJ Inc.

2022 New Jersey High Cost Limits Last Updated. The Internal Revenue Service IRS has announced an increase in the Flexible Spending Account FSA contribution limits for the Health Care Flexible Spending Account HCFSA and the Limited Expense Health Care FSA LEX HCFSA. Qualified Transportation plans 280month.

Home Care in Edison NJ Tagged With. You can contribute pretax dollars to fund the account. OMNIA Health Plans cover the all preventive care services identified by the federal health care reform law at 100 percent without any cost sharing ie copayment coinsurance or deductible amounts when.

IRS annual contribution limit for 2022. Listed below are the carriers approved to offer dental coverage to individuals in New Jersey shown in two groups. Qualified Parking plans 280 month.

Employees can elect up to the IRS limit and still receive the employer contribution in addition. Thus 2750 is the limit each employee may make per plan year regardless of the number of other individuals spouse dependent etc whose medical expenses are. Qualified Small Employer HRA QSEHRA increases to 5450year for single.

Elevate your health benefits. For plan year 2021 the HCFSALEXHCFSA carryover limit to the 2022 plan year is equal to 20 percent of 2750 or 550 to the 2022. The 2022 FSA contributions limit has been raised to 2850 for employee contributions compared to 2750 in 2021.

If you provide health care FSA employer contributions this amount is in addition to the amount that employees can elect. Contribution and Out-of-Pocket Limits for Health Savings Accounts and High-Deductible Health Plans. Step 2 Enroll to Start Saving.

This is a 100 increase from the 2021 health FSA limit of 2750. If you have adopted a 570 rollover for the health care FSA in 2022 any amount. And if an employers plan allows for carrying over unused health care FSA funds the maximum carryover amount has also risen up 20 from 550 in 2021 to 570 in 2022.

Employers should communicate their 2022 limit to their employees as part of the open enrollment process. On Wednesday November 10 2021 the Internal Revenue Service IRS released Revenue Procedure 2021-45 which officially increased the maximum Health Flexible Spending Account FSA contribution limit to 2850 for calendar year 2022. Excepted Benefit HRA remains 1800year.

The 2750 contribution limit applies on an employee-by-employee basis. The IRS announced that the health FSA dollar limit will increase to 2850 for 2022. Senior Compliance Attorney.

Bergen County NJ 07026 2022 FHA Loan Limits. A flexible spending account FSA is an employer-sponsored benefit that helps you save money on many qualified healthcare expenses. Home Care in Edison NJ Most people dont think about exploring their own limits as they go through their normal activities.

For the 2021 income year it is 2750 26 USC. Ad Custom benefits solutions for your business needs. Health FSA maximum carryover of unused amounts 570year.

Those that offer Stand-alone Dental Plans SADPs and those that do not offer SADPs. For 2022 participants may contribute up to an annual maximum of 2850 for a HCFSA or LEX HCFSA. FSAs only have one limit for individual and family health plan participation but if you and your spouse are lucky enough to each be offered an FSA at work you can.

After deciding how much to contribute to your account. For plan year 2022 in which the HCFSALEXHCFSA contribution limit is 2850 employees can carry over 20 percent of 2850 or 570 to the 2023 plan year. Federal Housing Administration FHA Loans are federally insured mortgages.

The usual carry-over limit is 550 You can also contribute up to the maximum allowed in. Ad 2022 Health Insurance Compare Shop. HSA contribution limit employer employee.

Medical mileage rate to obtain medical care reimbursable by a Health FSA. This is an increase of 100 from the 2021. The health FSA contribution limit is 2850 for 2022 up from 2750 in the prior year.

Generally speaking the dependent care FSA contribution limit is 5000 for single and joint filers and 2500 for married individuals filing separately 26 USC. These new limits also apply to limited-purpose FSAs. No Wait Times - Call Now.

2022 2021 Change. A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and. Check the Newest Plan Options.

So if you had 1000 in your account at the end of this year you could carry it all over into 2022. Get a free demo. Health Care FSA Limits Increase for 2022.

Affordable Healthcare Coverage for Families Individuals. Browse Personalized Plans Enroll Today Save 60. But if youre a family caregiver knowing your own limits and boundaries helps you to get the care your elderly loved one needs when she needs it.

The health FSA contribution limit is established annually and adjusted for inflation. Healthcare Agents Standing By.

High Deductible Health Plans Pros Cons And Faqs Goodrx

An Fsa Grace Period What It Is And What It Can Do For You Wex Inc

2021 Year Planner Hra Consulting Photo Yearly Planner Calendar Examples Planner

What Is A Dependent Care Fsa Wex Inc

What Are The 2022 Hsa Contribution Limits Wex Inc

Women S Health Pricing Billing Natera

Fsa Flexible Spending Account Benefits Wex Inc

/healthinsurance-5bfc32ab46e0fb00511afacf.jpg)

High Deductible Health Plan Hdhp Definition

Can I Pay For Mental Health Care Using My Fsa Or Hsa

Health Cards Healthcare Hsa Fsa Or Hra Cards Visa

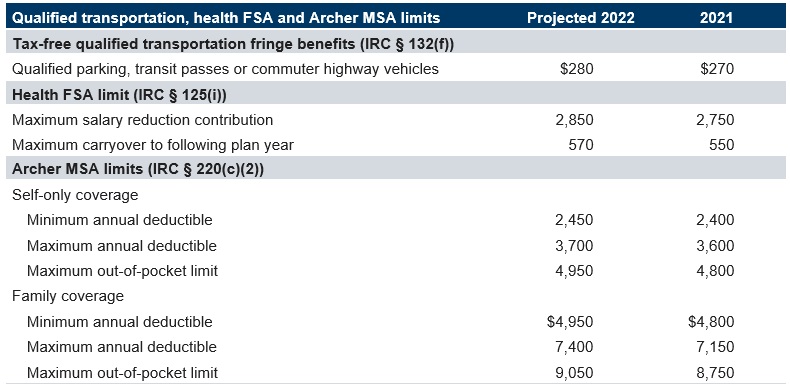

2022 Transportation Health Fsa And Archer Msa Limits Projected Mercer

Aquaphor Children S Itch Relief Ointment 1oz In 2022 Aquaphor Itch Relief Ointment

You Can Now Carryover 570 In Fsa Funds In 2022

Cocomelon Toothbrush In 2022 Brush Teeth Kids Brushing Teeth Sonic Toothbrush

How Much To Contribute To Your Fsa Hsa Kaiser Permanente

Plan Limits Employee Benefits Corporation Third Party Benefits Administrator

Hra Vs Fsa See The Benefits Of Each Wex Inc

:max_bytes(150000):strip_icc()/hra-vs-hsa-5190731_final-eec8d019c0a545009e049f4a96861d85.png)